Backdoor Roth Ira Limit 2025. Here's how those contribution limits stack up for the 2025 and 2025 tax years. What is a backdoor roth ira?

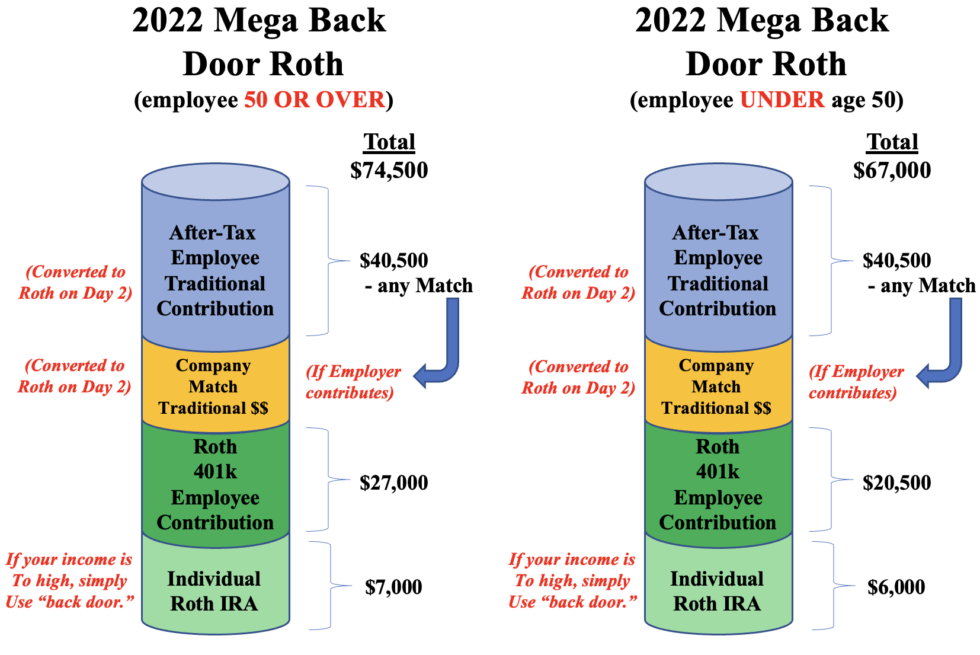

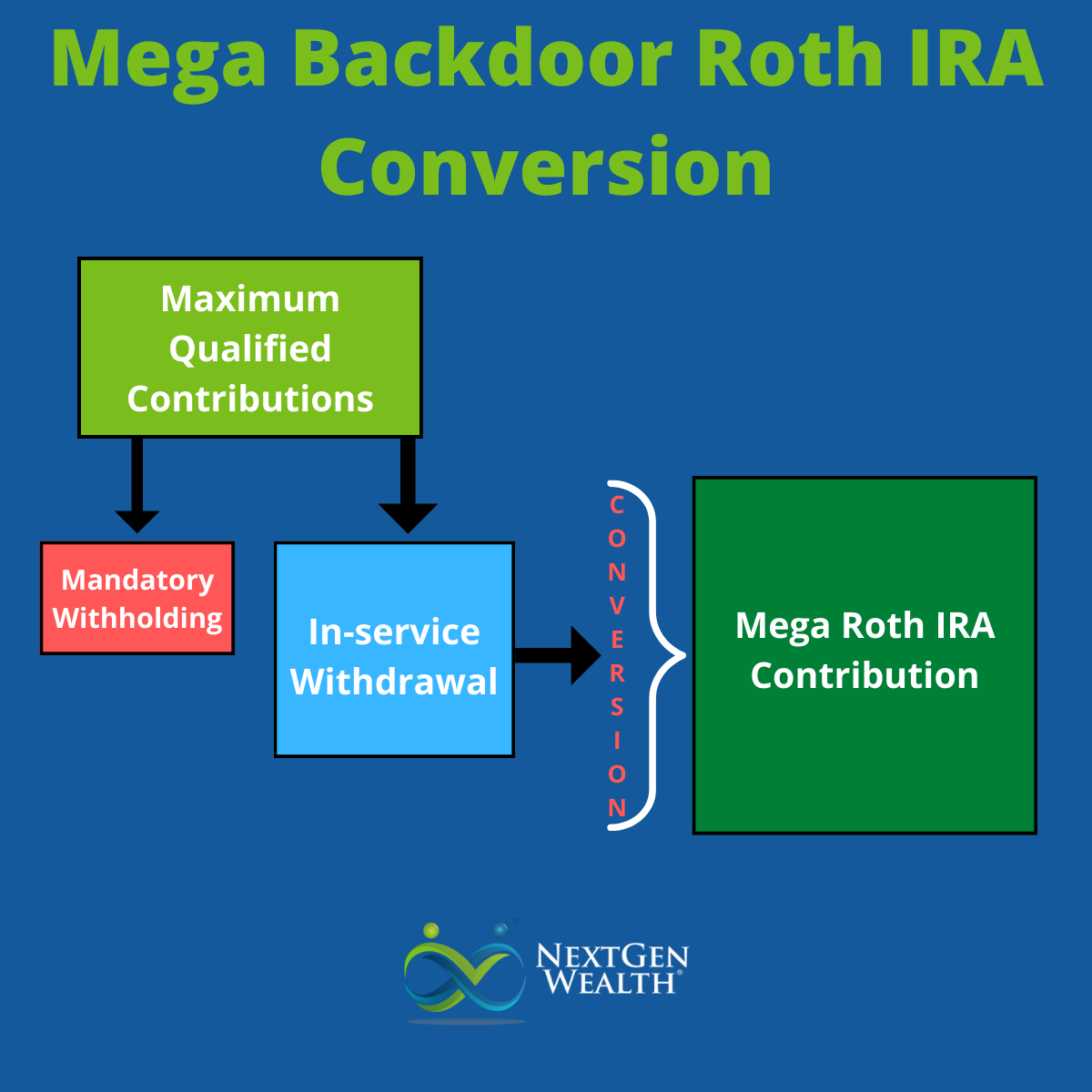

These limits increase to $7,000 and $8,000 for ages 50 and older in tax year 2025. The maximum mega backdoor roth ira conversion limit for 2025 is $69,000 for total 401(k) contributions ($76,5090 if 50 or older).

Backdoor Ira Limit 2025 Farah Maureene, The roth 401k contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

Backdoor Ira Contribution Limits 2025 Rivy Susana, For single filers, the limit was between $138,000 and.

2025 Mega Backdoor Roth Limit Kara Sandie, In tax year 2025, you may contribute up to $6,500 to a roth ira, or $7,500 if you are 50 or older.

Backdoor Roth Ira Contribution Limits 2025 Over 55 Pet Lebbie, The roth 401k contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions.

Backdoor Roth Ira Contribution Limits 2025 Catch Up Essie Jacynth, You can only perform a mega.

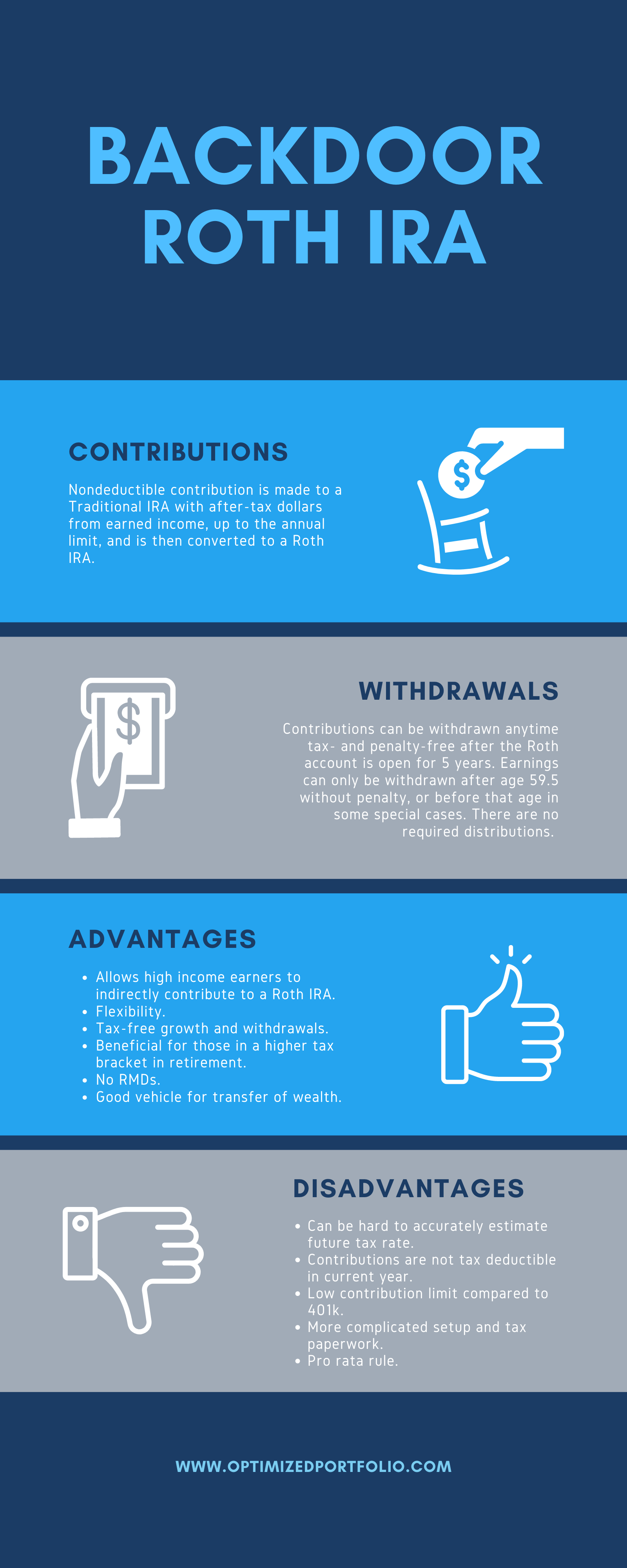

Backdoor Roth IRA Explained What, Where, Why, & How (2025), The backdoor method allows those with.

Roth Ira Contribution Limits 2025 Charts Amara Bethena, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth.