Property Tax King County 2025. Wilson thinks it’s likely many homeowners could see a reduced property tax bill. Assessed value and tax comparison by school district.

Residential property values in king county are expected to go down in 2025. You will need to fill out a separate application for each year.

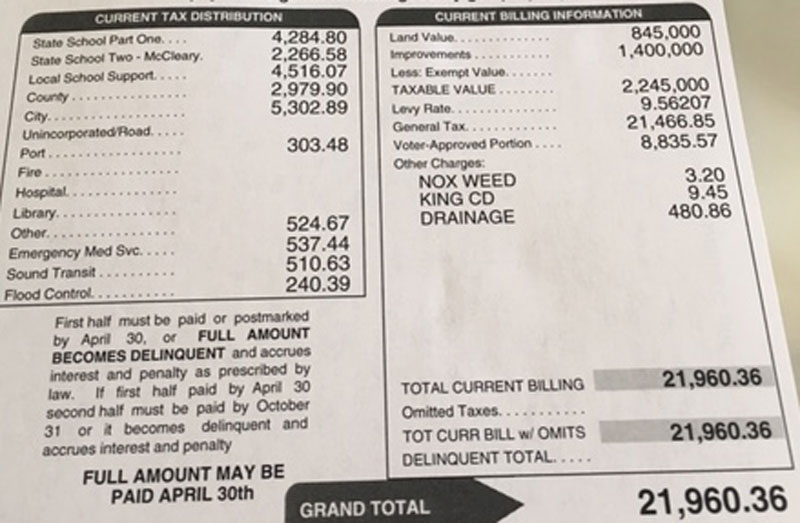

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

Property Tax King 2025, If you own property in king county, your bill for this year is due to be sent to you this week. For example, in february of 2025, you.

Property Tax King 2025, Download and view pdfs of the assessor’s annual reports for 2025. Call king county treasury operations.

Jefferson County Property Tax Exemption Form, King street center 201 south jackson street #710 seattle, wa 98104. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address.

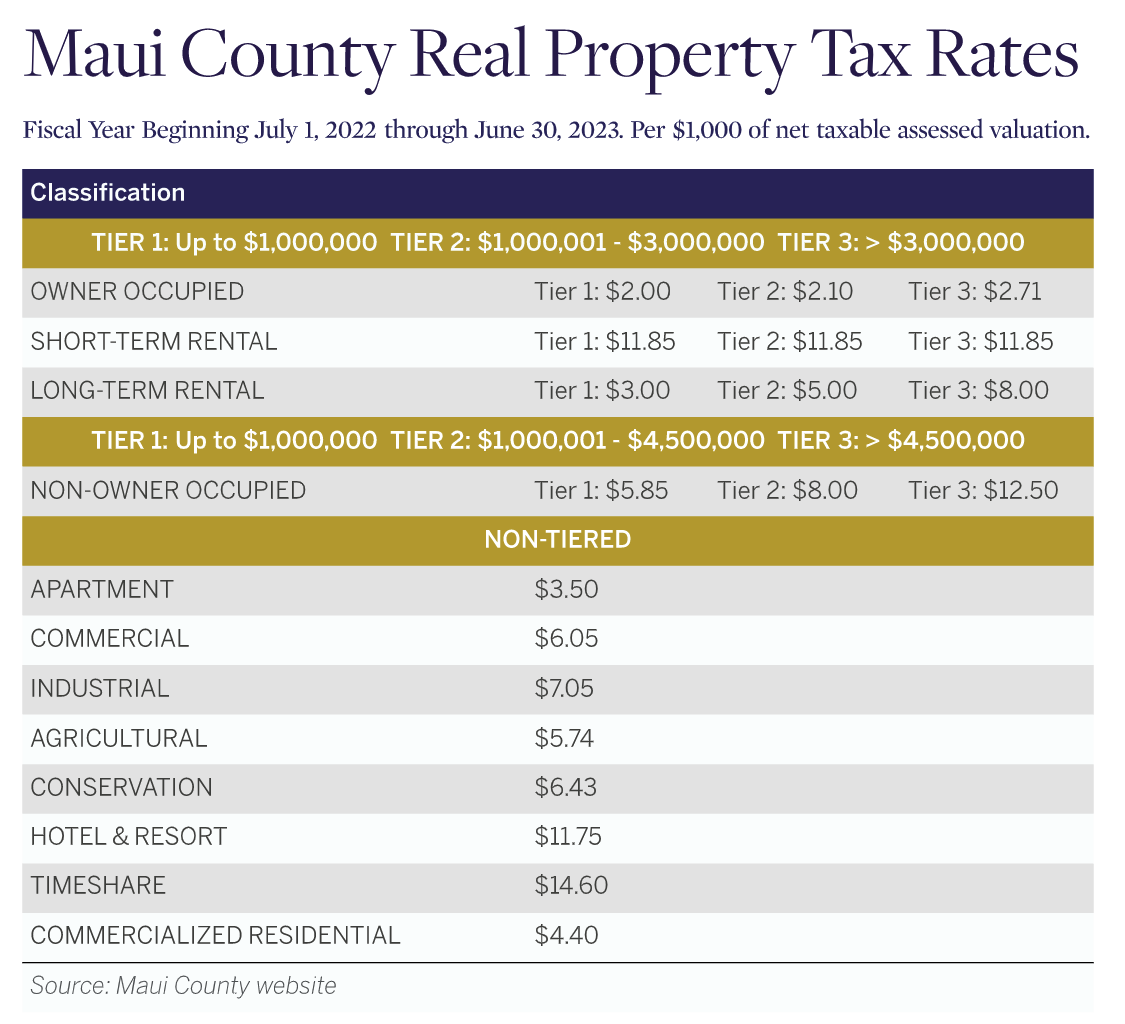

Maui Property Taxes 202223 Tax Rates, Use ereal property search to look up your parcel information by entering your address. If you own property in king county, your bill for this year is due to be sent to you this week.

Property Tax King 2025, If it is like last year, residential taxpayers will pay roughly 83% of the $7.6 billion due in property taxes. About assessors + property taxes + property value.

King County taxes may force 38year Capitol Hill neighbor out of town, The king county assessor’s initial report suggests places like queen anne could see an. Check your tax statement or property value notice.

Property Tax Deadline Nears For King County Homeowners Seattle, WA Patch, Tax account numbers are 10 or 12 digits. King street center 201 south jackson street #710 seattle, wa 98104.

King County Property Tax King County, Washington, You can apply for a property tax exemption for 2025, 2025, 2025 and 2025. Find out how to report your property.

How Much Is Property Tax In King County WOPROFERTY, To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. The median home value fell by $76,000, or around 11%, from 2025 to 2025 while the median property tax increased by around $425, or nearly 7%.

Property Tax King 2025, Consider the 2025 tax roll i just signed as county assessor. If it is like last year, residential taxpayers will pay roughly 83% of the $7.6 billion due in property taxes.